Improving Digital and Self-Service Effectiveness Enabling Claims Transformation

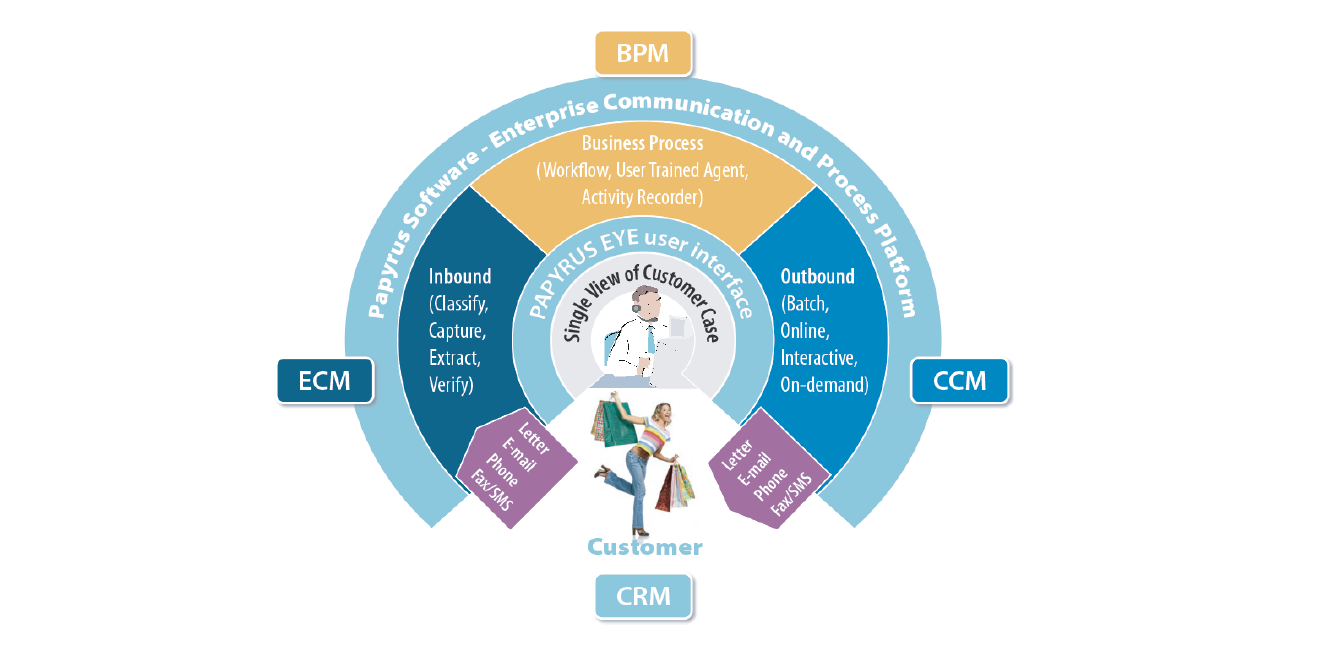

About Papyrus

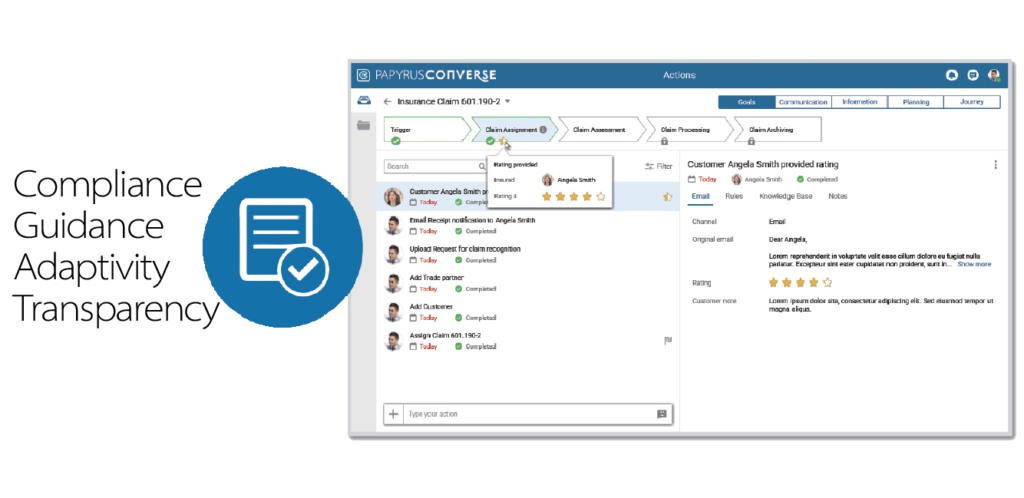

The easy-to-use Papyrus WebClient workplace connects the internal/external data, augmenting claim effciency through content service managment. Insurer teams can view tasks, collaborate and act upon the current status of a claim with a 360-degree view of the claimant and the claim case. Moreover, there is no need to switch between systems.

Manage Complexity

Transparency and control of the total claims process

Empowering the business for improved claimant experience

Robotic and adaptive in one

AI-User Trained

Boost adjust productivity with an

intelligent workbench

Main Features

1.

Streamline Claims First Notice of Loss (FNOL)

2.

Improve claimant experience by speeding up settlement

3.

Increase efficiency through frictionless processing & automation

Self-service portal

Papyrus Business Designer

Easy for claims business technology teams

Adapt to new situations

4.

Orchestrate recovery activities across the claim ecosystem

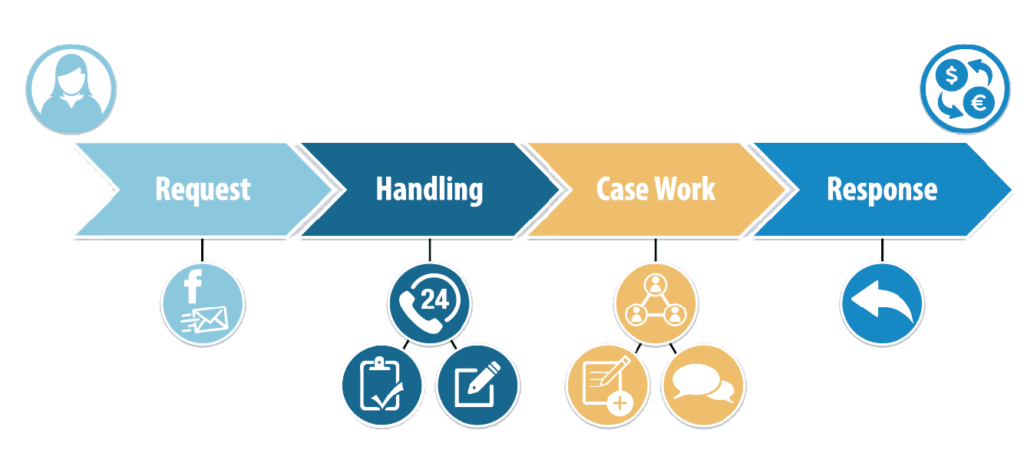

Depending on the severity of the claim case, requests are handled in an automated way or may require human judgment and tap into the knowledge and expertise of your employees who have the right skills, availability and authority to handle specific types of requests.

5.

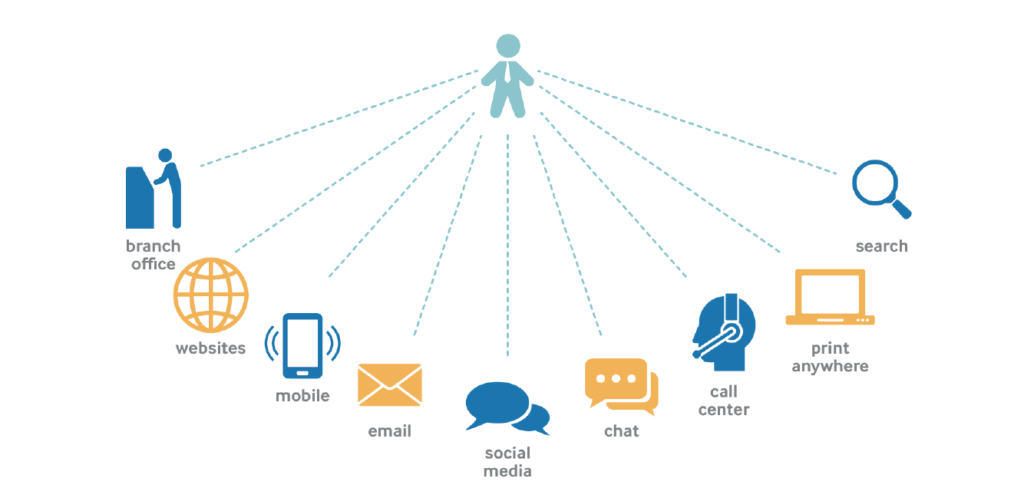

Provide Self-service for effective engagement with claimants and partners

They have a view of the complete incoming and outgoing communication, and can easily communicate back and forth with claimants and partners with ready-to-use templates and communication capabilities (phone, e-mail, SMS, etc.), which are made available directly through the workbench.

6.

Intelligent adjuster workplace & Business Designer for Agility

7.

Deliver Transparency