KYC / AML

KYC, or Know Your Customer, uses big data to quickly verify a customer's identity and manage risks for online services. This makes the approval process for users smoother.

AML, or Anti-Money Laundering, checks if customers in transactions are on a risk list and provides suggestions to stop them from doing illegal transactions.

Functions

Identify the customer

anti-money laundering risk

Through the risk control engine, sources are compared to the Dow Jones list to identify the customer anti-money laundering risk level with respect to different channels and customer types.

Regularly update client risk data

Well connected to world-renowned credit bureau, who regularly update the client risk list from the Dow Jones database.

Main Features

1.

Flexible list management and configuration

The list combination and the configuration of various business types can be flexibly used for screening purposes according to compliance requirements.

2.

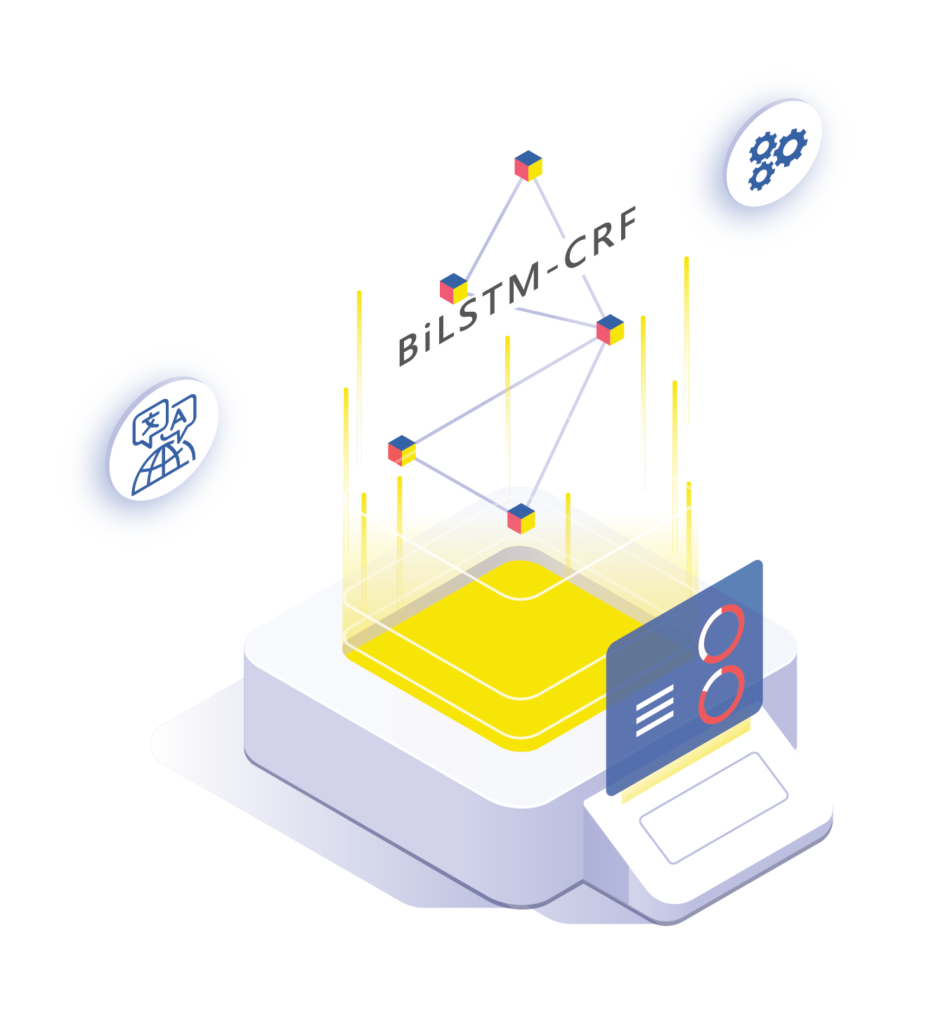

Intelligent Matching Algorithm

Supports multi-language exact matching and Chinese and English fuzzy matching. Two sets of different fuzzy matching algorithms are used for Chinese and English to improve the hit rate and reduce the false positive error rate.

3.

Self-developed deep learning model

Based on BiLSTM-CRF neural network algorithm, self-developed deep learning model suitable for Chinese address word segmentation tagging.