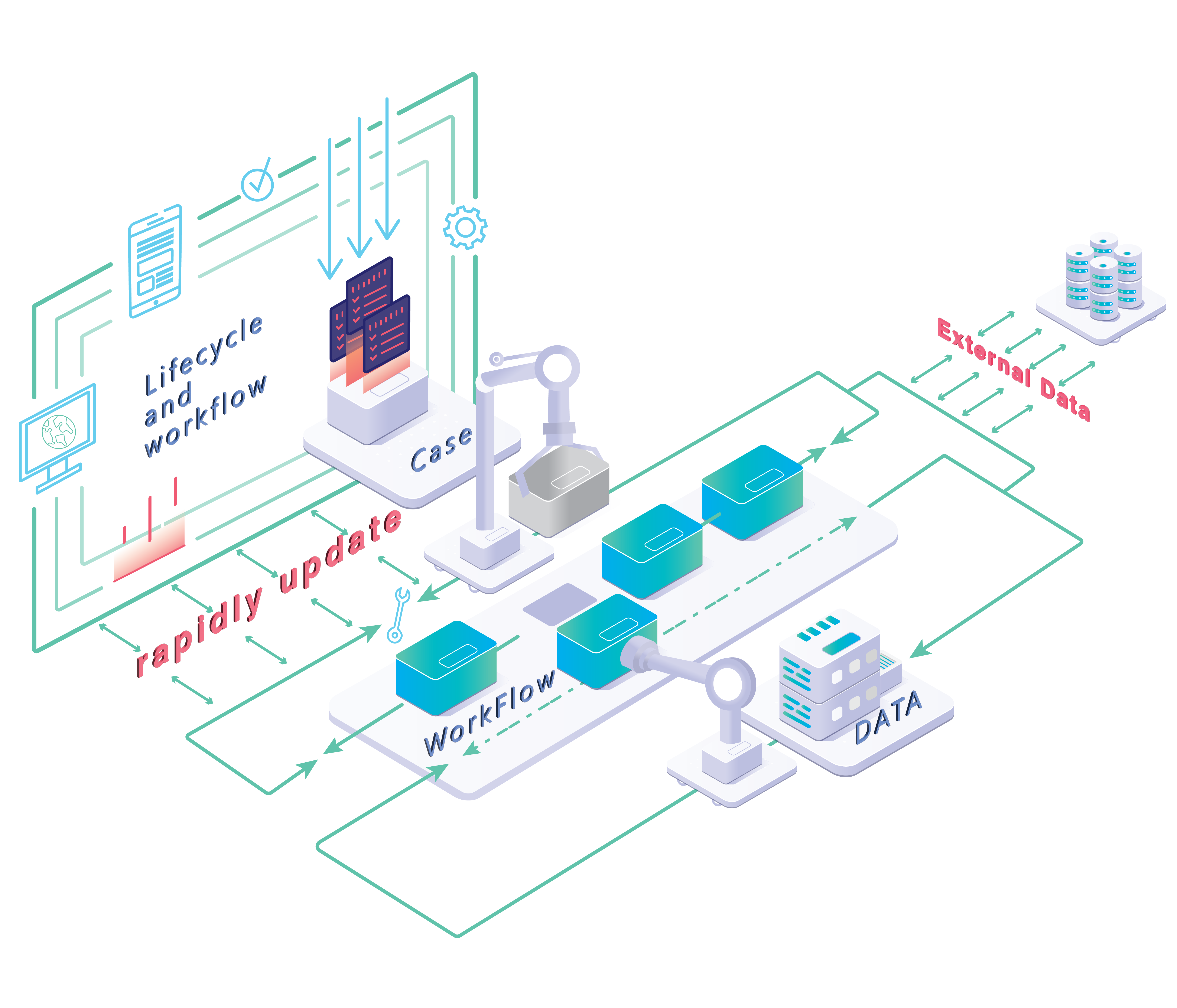

Lifecycle and Workflow

Functions

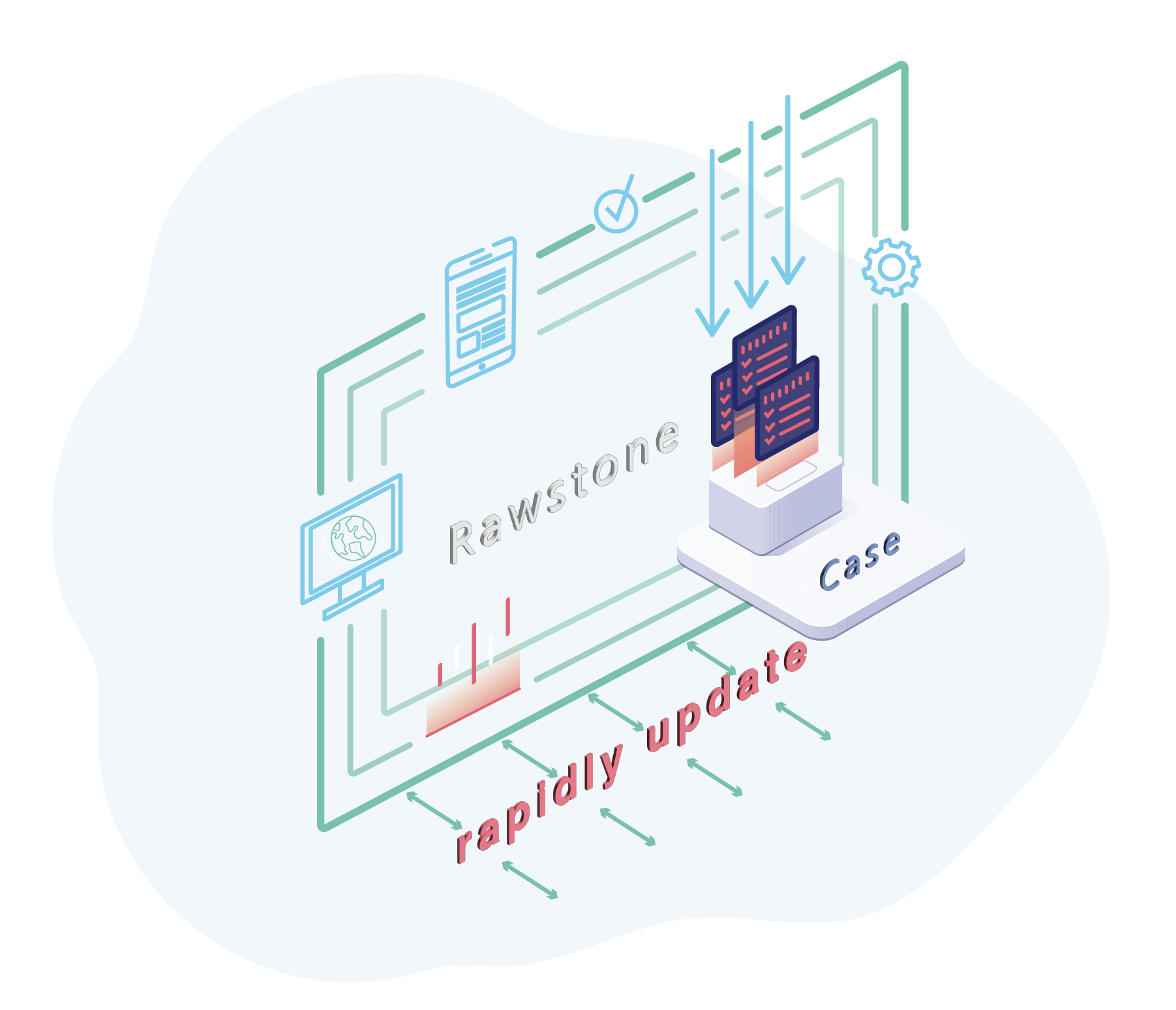

Unified management for all case application, documents, clients,

and case life cycle.

Generate management reports in a unified way, providing managers with different authorities to view the overall business progress, conversion rate results, and the issue status and exceptions to intervention.

Provide Adapter to connect with necessary external data such as

core system, audit system, JCIC,

financial company, etc.

Main Features

1.

2.

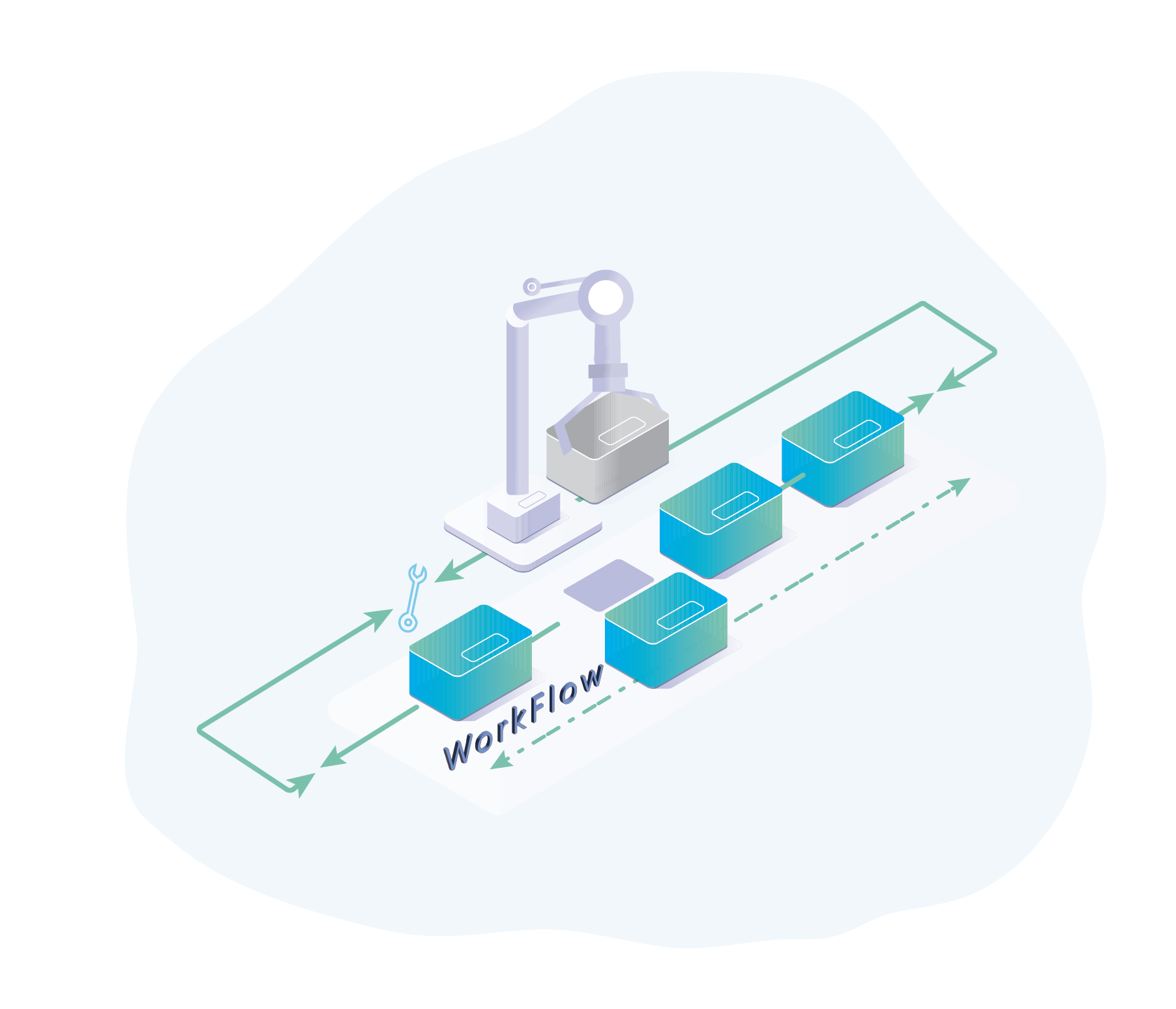

Micro-service architecture can be quickly expanded with different functional modules, allowing the need of business and system requirements to be more speedily fulfilled.

3.

The data management framework specially designed for Client Lifecycle Management improves the scalability upon adding different successive processes.

4.

The customer credit investigation procedure is automated (RPA) to speed up the case review process and reduce the manual review time.

5.

Provide automated process monitoring, according to the formulated process SLA.

After time needed for each level or for the entire process is determined, issue warning reports will be produced.